Success in trading comes from staying current with the latest development in trading and the markets.

NEXT LEVEL ORDER FLOW TRADING

A NEW course designed to help you take your order flow analysis and trading to the next level and become a better trader in a short period of time.

ABout NEXT THE LEVEL ORDER FLOW TRADING COURSE

My name is Michael Valtos, the founder of Orderflows.com, and I’m here to tell you about my order flow trading course that has helped people around the world become profitable traders. I have over 25 years of experience as a professional institutional trader, and I have made it my goal to share my experience and knowledge with those interested in learning how to trade order flow successfully. Statistics show that 90% of traders are doing it wrong and that is why most are losing money or just breaking even. It doesn’t have to be that way because successful trading is repeatable. I think you will find my course to be one of the best resources for furthering your trading education you will ever find.

For almost 25 years I was part of the "smart money" group who moves prices to levels to find liquidity and generate profits for ourselves, at your expense. Over the years I’ve refined these methods so that anyone can understand them. If you follow the smart money, you’ll do well. Ignore it, and face the consequences. Curious why the market can easily move through support and resistance as opposed to stopping there? I’ll show why and how you can think like smart money to be on the winning side of more of your trades from now on.

I have taught thousands of traders in over 35 countries worldwide how to use order flow to trade so, yes, you can learn it to. I really believe that if you are serious about trading and understanding order flow you should be offered the same opportunities that proprietary traders have access to.

For almost 25 years I was part of the "smart money" group who moves prices to levels to find liquidity and generate profits for ourselves, at your expense. Over the years I’ve refined these methods so that anyone can understand them. If you follow the smart money, you’ll do well. Ignore it, and face the consequences. Curious why the market can easily move through support and resistance as opposed to stopping there? I’ll show why and how you can think like smart money to be on the winning side of more of your trades from now on.

I have taught thousands of traders in over 35 countries worldwide how to use order flow to trade so, yes, you can learn it to. I really believe that if you are serious about trading and understanding order flow you should be offered the same opportunities that proprietary traders have access to.

I designed The Next Level Order Flow Trading Course for one reason…to demonstrate how I have done it and how anyone can do the same!

NOTE: This information has never been released in any other training course before. It’s my secret sauce and this is the first time I’ve ever shared it with anyone.

NOTE: This information has never been released in any other training course before. It’s my secret sauce and this is the first time I’ve ever shared it with anyone.

what is covered in the lessons

Successful traders don’t rely on canned indicators that come with a trading platform to get their trading edge. Their edge comes from knowing how to read order flow and volume. This is a significant advantage. Combined with an understanding of market structure, the ability to read the order flow as the market trades is where they find their edge. It is what separates winning traders from losing traders.

Successful traders have developed their ability to read the buying and selling in the markets they trade and whether demand (buying) or supply (selling) is dominant and in control.

When you combine order flow with an understanding of market structure and exactly where to take trades, the successful trader has an edge over other traders in the markets. Once you learn how to read the order flow, you can have this same edge.

Successful traders have developed their ability to read the buying and selling in the markets they trade and whether demand (buying) or supply (selling) is dominant and in control.

When you combine order flow with an understanding of market structure and exactly where to take trades, the successful trader has an edge over other traders in the markets. Once you learn how to read the order flow, you can have this same edge.

Next Level Order Flow Trading Course Modules:

What you will learn in Next Level Order Flow is much more than equivalent to a full week of a seminar training... but at a fraction of the price!, plus the lessons can be watched over and over again.

This package is available right now for you to access and start watching instantly, and for a fraction of the cost of other order flow training alternatives. Learn at your own pace that fits your time schedule!

Read the detailed descriptions of the contents below and I think you will agree that this is outstanding value at the current low price... which will not be at the current low introductory price much longer!

This package is available right now for you to access and start watching instantly, and for a fraction of the cost of other order flow training alternatives. Learn at your own pace that fits your time schedule!

Read the detailed descriptions of the contents below and I think you will agree that this is outstanding value at the current low price... which will not be at the current low introductory price much longer!

- Module 1 -

Market Reality

Market Reality

In Module 1: Market Reality you will learn the reality of the markets. The markets don't move in a text book manner as a lot of people would have you believe. You will learn what really moves the market and how to see this activity.

- Module 2 -

Order Flow Foundations

Order Flow Foundations

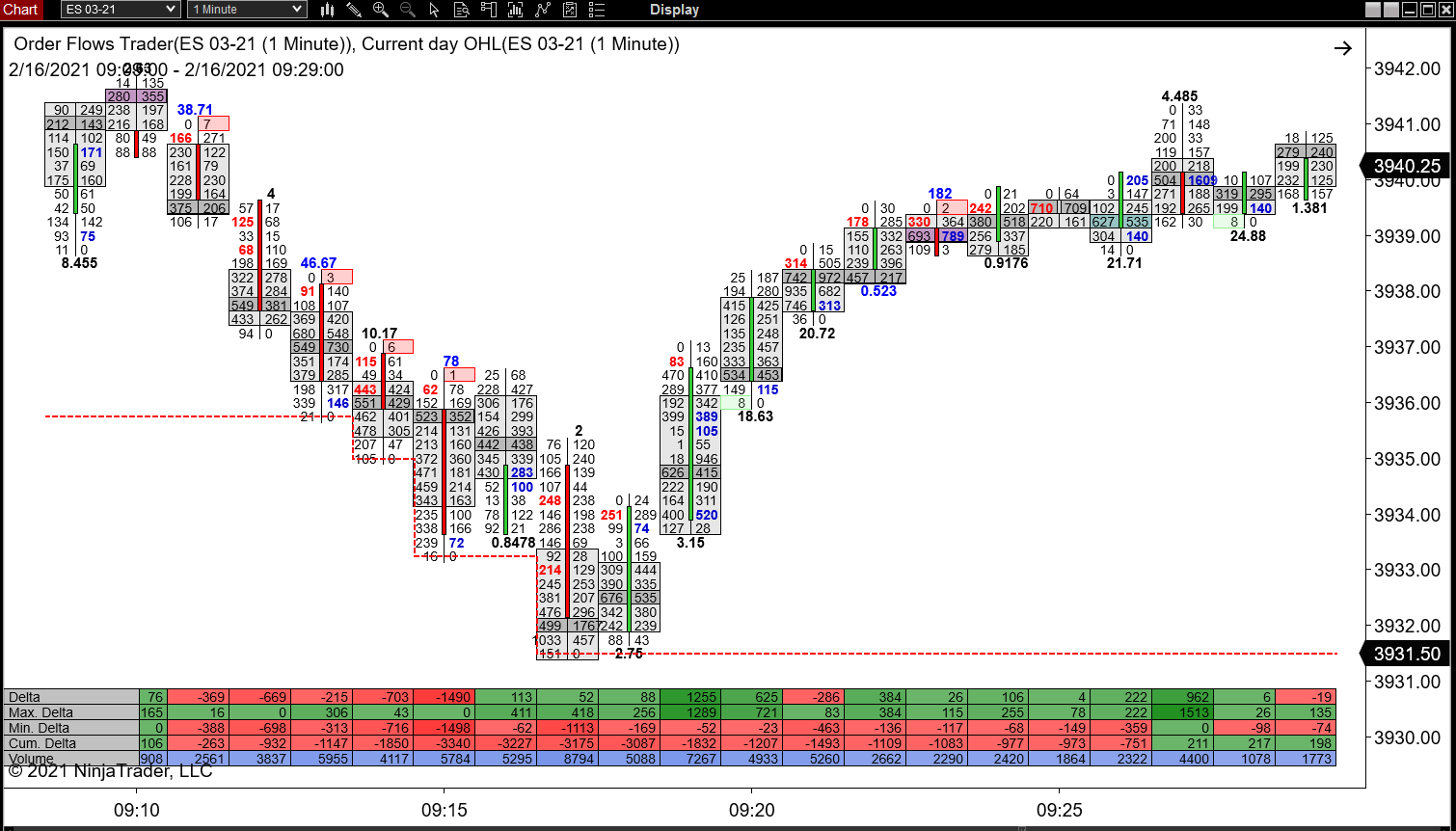

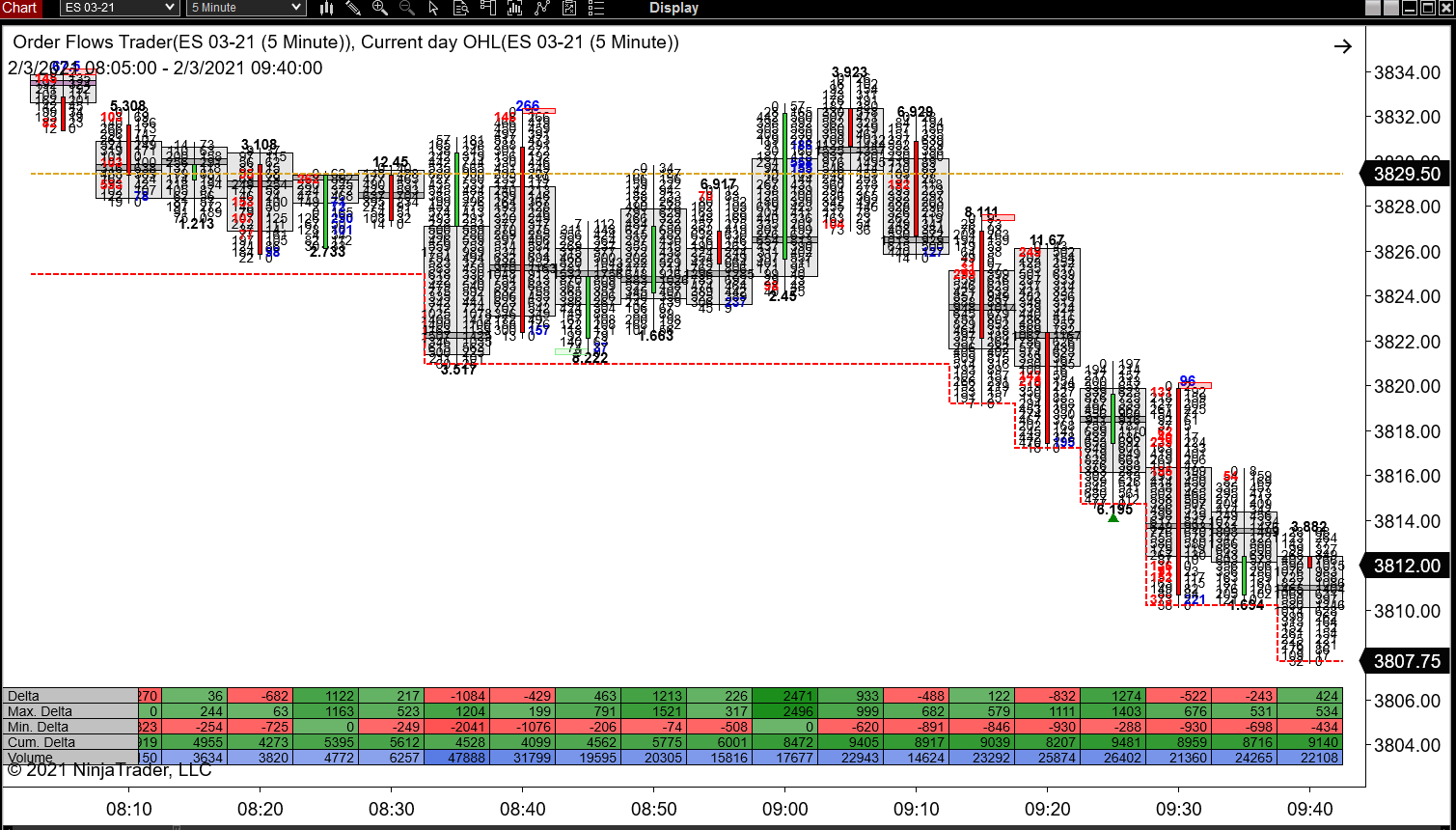

In Module 2: Order Flow Foundations you will learn more about the building blocks of order flow from which most order flow analysis is derived from. This is not an explanation of what Delta, POC and Imbalances as you

probably already know what they are. Instead this is more in-depth on how to apply those pieces of data for better trading decisions.

probably already know what they are. Instead this is more in-depth on how to apply those pieces of data for better trading decisions.

- Module 3 -

Momentum

Momentum

In Module 3: Momentum you will learn more about understanding order flow

momentum. Momentum is the most common form of market analysis and it blends well together with order flow because with the data derived from order flow

a trader can better understand when momentum is starting or ending.

momentum. Momentum is the most common form of market analysis and it blends well together with order flow because with the data derived from order flow

a trader can better understand when momentum is starting or ending.

- Module 4 -

Volatility

Volatility

In Module 4: Volatility you will learn more about how to recognize volatility in the order flow and when a market starts exhibiting volatility so you can take advantage of it. When there is volatility, the market facilitates trade over a wider range of prices.

- Module 5 -

Balance

Balance

In Module 5: Balance you will learn more about the market’s job which is to find balance where two-sided trade can occur. When a market is in balance, it is signaling that it is looking for or waiting for more information so that it can start its move out of balance. When that move out of balance starts that is a hard trade for many traders to take.

- Module 6 -

Volume

Volume

In Module 6: Volume you will learn how volume fits in with order flow. Volume is the backbone of the market. Some call it the fuel of the market. But one thing you have to know is the market needs volume to facilitate trade. Being able to see price levels where heavy volume traded will help you determine what is going to happen in the market.

- Module 7 -

Value

Value

In Module 7: Value you will learn about structure of the market. Traders love to trade price, but price without context mean little. A trader needs to have a clear view of what the market is doing right now relative to the overall market picture. When you start to focus on value instead of price you will have a much better understanding of what is happening under the surface of the market, which is price. If you are just following price, you often get confused and worse, chopped up in the market when prices go up and go down.

- Module 8 -

Flow Driven Market

Flow Driven Market

In Module 8: Flow Driven Market is a condition that occurs when traders are more initiating in their trading because they want to get in now. Flow driven markets offer some of the best trading opportunities because you will be trading in the correct direction of the market. A flow driven market is dominated by big players who have no respect for technical levels and this is why you see support and resistance fail or pivot levels fail because the market is not in a technically driven market condition. Knowing what trading condition the market is in puts you ahead of other traders out there you are trading against.

- Module 9 -

Trade Setups

Trade Setups

In Module 9: Trade Setups you will learn 7 order flow trade setups:

Thin Spots

Effort – No Result

Squeeze Play

Strong Moves That Dry Out

One Ticked

Value Rejection

Value Gaps

Thin Spots

Effort – No Result

Squeeze Play

Strong Moves That Dry Out

One Ticked

Value Rejection

Value Gaps

- Module 10 -

The Process

The Process

In Module 10: The Process you will learn more about the trading process. The problem many traders face is the lack of a process. They think they can have a method or system or indicator to trade the market and be successful. However, having a method or a system or indicator are just the parts of the process.

- Module 11 -

Risk Management

Risk Management

In Module 11: Risk Management you will learn more about what really is risk management. Risk management is really trading - managing your position once you are in it. But this module is NOT the usual lesson on risk/reward. Instead it is about trade entry, trade exit, managing the trade once you are in it to either maximize a trade or cut losses quickly by understanding the order flow.

- Module 12 -

Wrap Up

Wrap Up

In Module 12: Wrap Up you will now be able to put the moving pieces of market information, specifically, the order flow, together to make better, more informed trades because you will have an understanding of the market that your competitors don't have.

No other trading mentor or trading course is able to teach you what you will learn in this course because what I teach you is proprietary trading information.

You will learn about Flow Driven Markets...

You will learn about Value in the Order Flow...

You will learn about Momentum in the Order Flow...

And Learn Much, Much More...

Here’s Your Chance to Tap Into My Most Effective and Little-Known Order Flow Analysis to Help You learn to Master the Skill of Trading and Save You a Lot Of Time, and Frustration in the Process!

This course includes

All lessons are recorded and can be viewed on demand, anytime of the day. The videos can be watched online or downloaded to your PC.

All lessons include the PDF slide deck so that you can download them, print them and make your own notes on. The PDF are the guide for what is discussed in the video lessons.

You will get lifetime access to this course, without any limits. You can access The Next Level Order Flow Trading Course anytime from anywhere in the world.

Proprietary Information Offered No Where Else!

Get ACCESS Now For $297

Gain instant access to the Next Level Order Flow course for just a one time payment of just $297.

This is a truly low price for such a package of proprietary content, you can't learn this material anywhere else.

This is a truly low price for such a package of proprietary content, you can't learn this material anywhere else.

Once your payment has been processed, your login information will be sent to your PayPal registered email address used to complete your PayPal transaction. All emails are usually sent within 3-6 hours. Please check your PayPal registered email address for course details.

FAQs

Q: I have your Order Flow Trading Course and Advanced Order Flow Trading Course, is this the same material?

A: No, the information in Next Level Order Flow Trading is fresh and not covered in previous courses I have released.

Q: Does this include the software, Orderflows Trader 3.0?

A: No, this is a trading course, not a trading software. To purchase the Orderflows Trader 3.0 software please visit this link: Orderflows Trader 3.0

Q: I am new to order flow. Is this course too advanced for me?

A: Next Level Order Flow is designed for traders of all levels. What is most important is that you get started.

Q: I trade Forex, can I use what you teach on Forex pairs?

A: Yes, you can apply what you learn from Next Level Order Flow to all markets. I prefer Futures, but you can also apply the knowledge to stocks, forex and even crypto.

Q: How long will it take me to go through the Next Level Order Flow Trading Course?

A: Everyone is different but I would suggest spending at least 1-2 hours a day. There is a lot of information to absorb, albeit in a very digestible format, so take it easy and work at your own pace.

A: No, the information in Next Level Order Flow Trading is fresh and not covered in previous courses I have released.

Q: Does this include the software, Orderflows Trader 3.0?

A: No, this is a trading course, not a trading software. To purchase the Orderflows Trader 3.0 software please visit this link: Orderflows Trader 3.0

Q: I am new to order flow. Is this course too advanced for me?

A: Next Level Order Flow is designed for traders of all levels. What is most important is that you get started.

Q: I trade Forex, can I use what you teach on Forex pairs?

A: Yes, you can apply what you learn from Next Level Order Flow to all markets. I prefer Futures, but you can also apply the knowledge to stocks, forex and even crypto.

Q: How long will it take me to go through the Next Level Order Flow Trading Course?

A: Everyone is different but I would suggest spending at least 1-2 hours a day. There is a lot of information to absorb, albeit in a very digestible format, so take it easy and work at your own pace.

Copyright 2021 - Orderflows.com - All rights reserved

Disclaimer:

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities. The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

CFTC Rules 4.41:

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

©Orderflows.com | ©nextlevelorderflow.com

Disclaimer:

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities. The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

CFTC Rules 4.41:

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

©Orderflows.com | ©nextlevelorderflow.com

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..